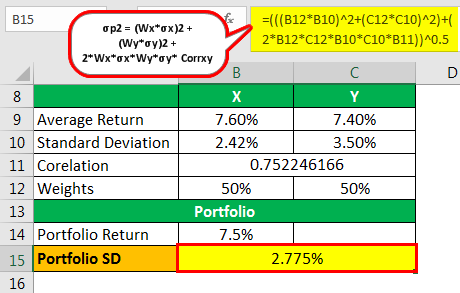

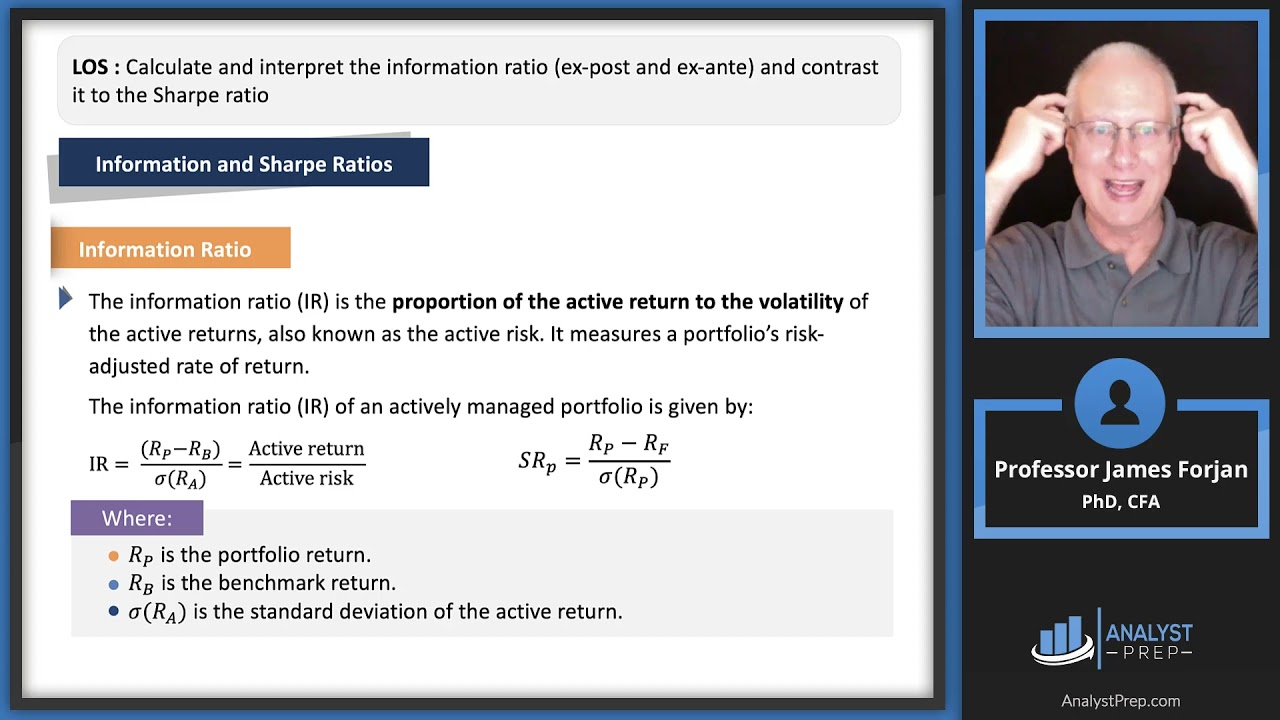

Expected Value, Variance, Standard Deviation, Covariances, and Correlations of Portfolio Returns - AnalystPrep | CFA® Exam Study Notes

CFA Level 3 - Résumé - CFA Level 3: Summary Reading 1: The Behavioral Biases of Individuals: I. - Studocu

Jason Charette, CPA, CA, MBA, FRM, CFA - Director, Corporate Client Group - Portfolio Management - RBC | LinkedIn

PDF) Absence of Value: An Analysis of Investment Allocation Decisions by Institutional Plan Sponsors