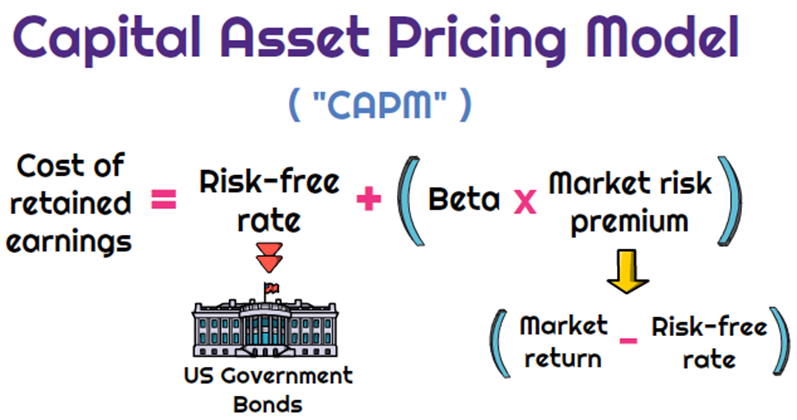

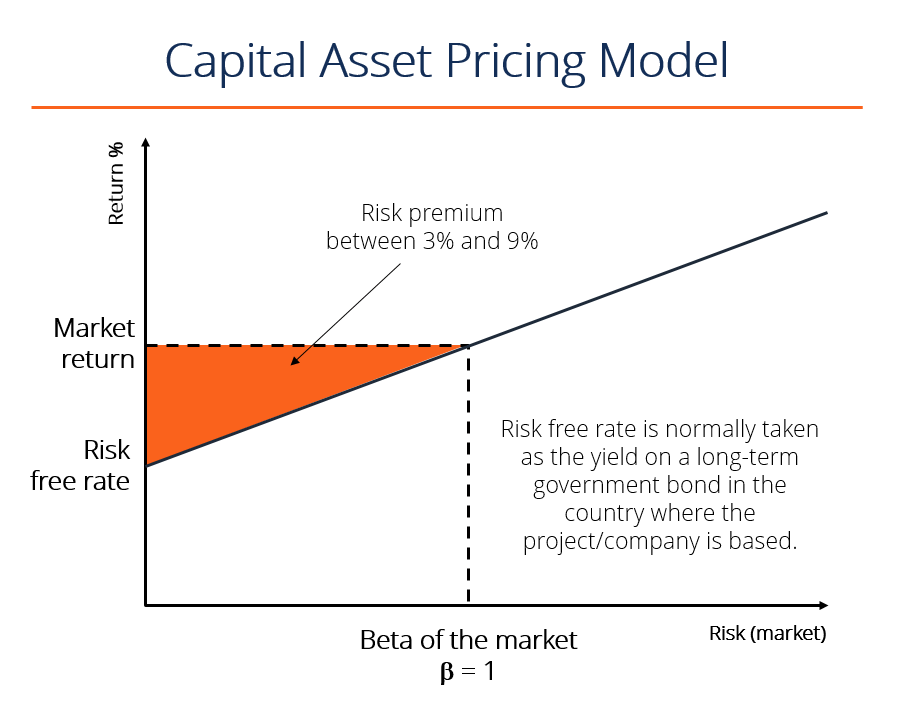

Assume that the risk free rate of interest is 3%, the market risk premium is 5%, and that the Betas for Dell and General Mills are 1.2 and 0.8 respectively. According to

portfolio - How do you determine the risk free rate of an asset? - Personal Finance & Money Stack Exchange

:max_bytes(150000):strip_icc()/tesla-b2b7e254720442248700b97e303b201d.jpg)

%2013.47.03.png)

:max_bytes(150000):strip_icc()/risk-freerate.asp-edit-a2c93f907857401dad61e4bde612c04a.jpg)